Most founders are addicts, not to drugs, but to dilution.

They think the only way to fund a growth spurt or an inventory run is to go hat-in-hand to VCs and sell a piece of their soul. Since I started in the consumer space in 2014, I’ve seen some of the best brands on the planet stall out because they didn't realize that capital strategy is a marketing lever.

If you’re a Series A founder and your "strategy" is just spending your equity on Meta ads, you are doing it wrong.

Here is the masterclass in modern capital strategy that will save you from expensive debt and unnecessary dilution.

1. The "Amex Trap" (Your 30-day terms are a lie)

Most of you have a business card like an Amex. You think you have 30 days to pay the bill.

The Reality: Your "True Float" is usually closer to 15 days. Between the statement closing and the due date, the math rarely works in your favor. If you’re a high-growth brand, you’re basically paying for your ads before the customer’s credit card even clears your Shopify account.

The Flex Play: Connor and his team offer Net 60 terms on every transaction. By moving from a 15-day float to a 60-day float, you gain 45 extra days of cash on hand. In DTC math, 45 days is an entire extra cycle of inventory or a massive ad spend window. It’s the difference between "surviving" a month and "scaling" a quarter without touching your bank account.

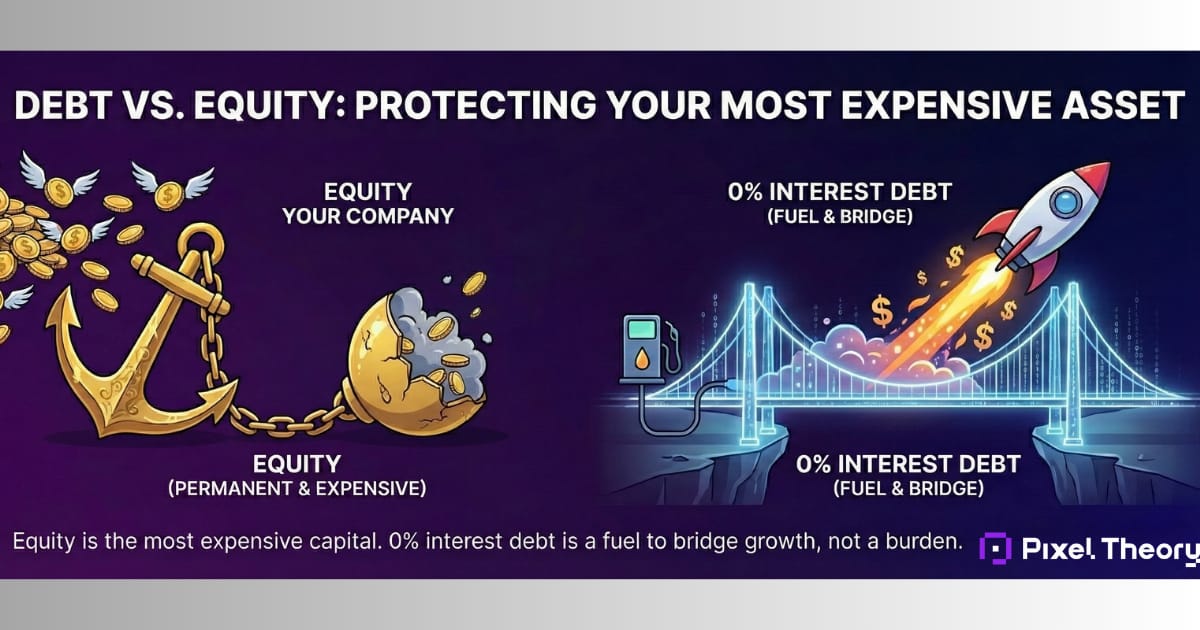

2. Debt vs. Equity: Protecting Your Most Expensive Asset

"Debt" is a scary word for founders because they associate it with predatory consumer lending.

Get over it. Equity is the most expensive form of capital in the world. It’s permanent. 0% interest debt is a bridge.

The "sweet spot" here is post-Series A. You’ve raised the money, you have the operators, but your initiatives are outstripping your cash flow. Using a tool like Flex acts as a 2-3 month bridge while you’re waiting for a round to close or revenue to hit.

If it’s 0% interest, it’s not a burden, it’s fuel.

3. The "Seasonality Dial" (The Operator’s Secret)

Most people treat their credit card as a passive tool. Seasoned operators use it like a dial.

The Black Friday Play: In Q4, you don’t need time; you need margin. You switch your Flex settings to High Cash Back. Since your ad spend is 5x higher than normal, you use the rebates to pad your bottom line.

The Post-Holiday Pivot: Once January hits and you need to fund a massive inventory order for spring, you switch the dial back to Extended Terms (Net 60). You effectively sell the product before the bill for the inventory even arrives. That is how you win the cash flow game.

4. Is this going to mess up my Balance Sheet?

I asked Connor the "CFO question." If you have a loan with Highbeam or you're raising a Series B, does this block you?

No. Flex is unsecured junior debt. It doesn't require collateral and it doesn't "sit on top" of your other lenders. It’s a non-exclusive tool. You can use Flex for your daily card spend (to get that 60-day float) while still using revenue-based advances for the big stuff.

Bonus for the fast-movers: They also just launched Flex Capital. It’s Revenue-Based Financing (RBF) that competes with Clearco or Wayflyer. Because of their lending partnerships, they are winning on a "race to the bottom" for rates.

If you have Shopify or Amazon data, they can issue capital in 24 hours.

The Takeaway

Stop being a funding addict.

The difference between a "Growth Partner" and a "Growth Agency" is that we look at the P&L. If you aren't optimizing your float, you're leaving 45 days of growth on the table.

If you want to see how Flex can bridge your next 60 days of spend at 0%, you should talk to Connor. He’s the real deal.

We work closely with Connor and Flex at Pixel Theory, if you want me to directly connect you two send me a note…