Black Friday 2025 just shattered records. But if you look under the hood, the engine is sputtering.

The headlines are celebrating an $11.8 Billion day in the U.S. (+9.1% YoY). Shopify merchants alone processed $6.2 Billion (+25% YoY).

On paper, the consumer is thriving. In reality, they are "surgical," debt-laden, and buying less.

Here is the definitive recap of what actually happened last week—and why the "growth" you're seeing might be an illusion.

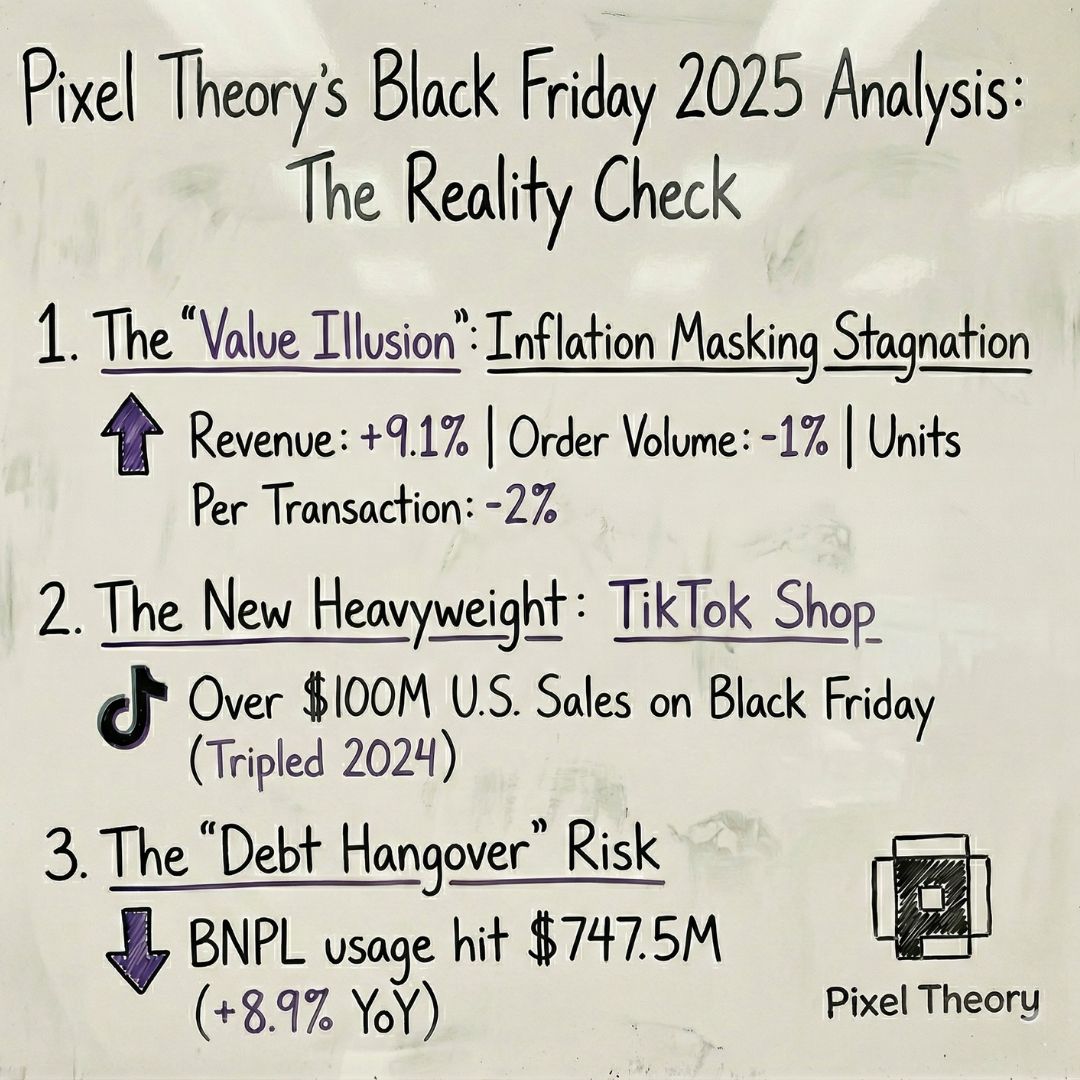

1. The "Value Illusion": Inflation Masking Stagnation

This is the most critical insight for every founder and operator.

While top-line revenue soared, unit volume dropped.

Revenue: Up +9.1%

Order Volume: Down -1%

Units Per Transaction: Down -2%

The growth wasn't driven by consumption; it was driven by price. The Average Selling Price (ASP) rose 7%. Consumers spent more money to acquire fewer goods.

The takeaway: If your revenue is up but your unit volume is flat, you aren't growing. You're just riding inflation.

2. The New Heavyweight: TikTok Shop

If 2024 was the arrival, 2025 was the coronation.

TikTok Shop generated over $100 million in sales in the U.S. on Black Friday alone—tripling its 2024 performance.

We witnessed a structural shift: social commerce moved from "discovery" to "conversion." This wasn't just viral dropshippers; legacy brands like Crocs, Fenty Beauty, and Medicube dominated the feed.

For DTC brands, the signal is clear: If you don't have a TikTok Shop strategy for 2026, you are leaving 20%+ of your potential revenue on the table.

3. The "Debt Hangover" Risk

How did cash-strapped consumers fund this record spend? Debt.

Buy Now, Pay Later (BNPL) usage hit $747.5 million on Black Friday (+8.9% YoY).

This creates a massive risk for Q1. The consumer is borrowing from their future self. Expect a "spending hangover" in January as bills come due.

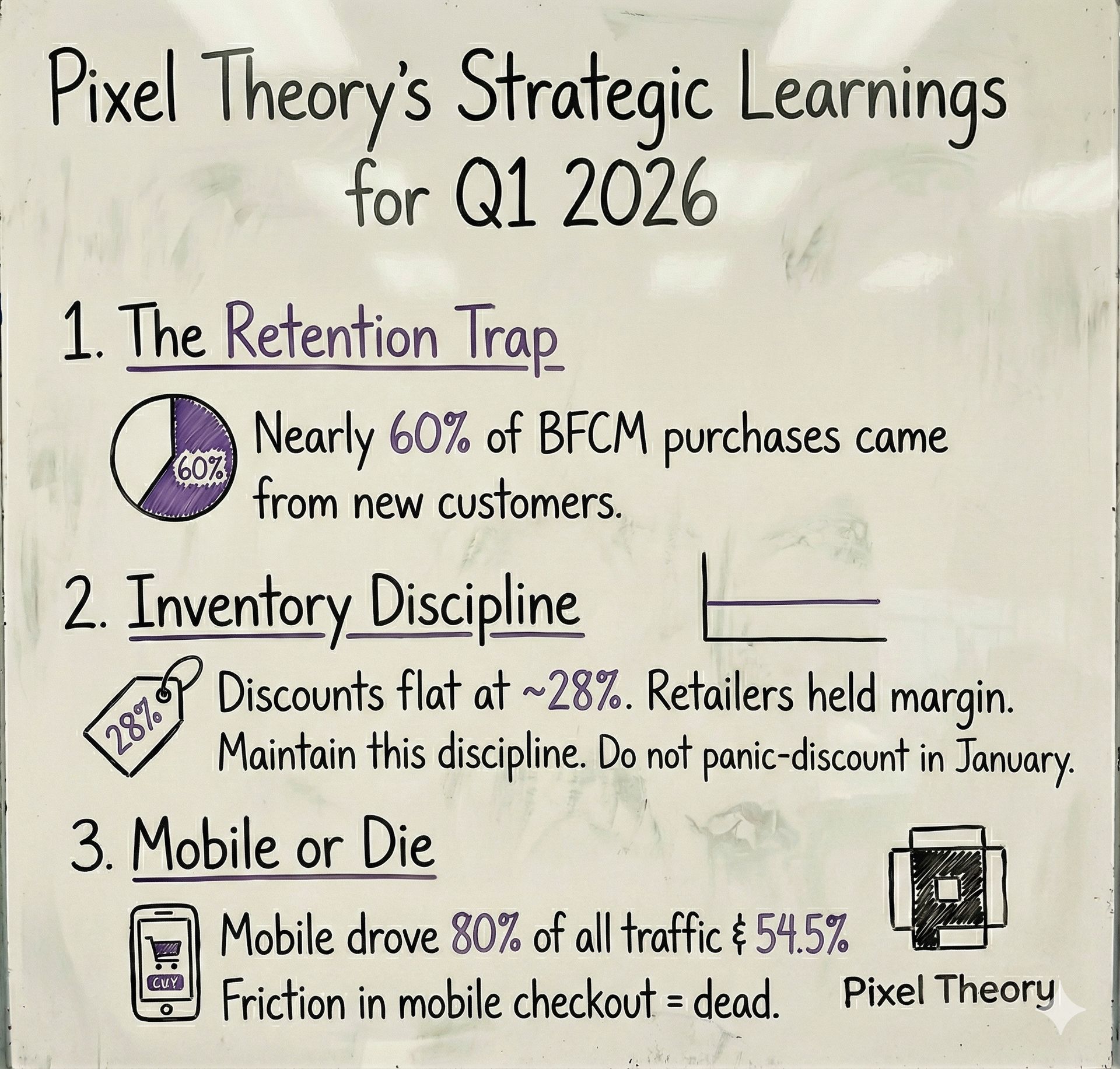

Strategic Learnings for Q1 2026

The Retention Trap: Nearly 60% of BFCM purchases came from new customers. Your primary goal for Q1 must be LTV. Segment these buyers immediately. If you don't have a second-purchase flow ready, you will bleed CAC.

Inventory Discipline: Discounts remained flat at ~28%. Retailers held the line on margin. Maintain this discipline. Do not panic-discount in January unless you are sitting on dead stock.

Mobile or Die: Mobile drove 80% of all traffic and 54.5% of sales. If your mobile checkout has friction, you're dead.

Black Friday 2025 proved the consumer is still spending, but they are doing it with surgical precision. The "easy money" era of arbitrage is over.

Efficiency and retention are now the only metrics that matter.